As a parent/caregiver to your loved one with autism or other intellectual or developmental disability, you’ve worked hard to ensure they receive the best care possible. But what if something happens to you? How can you protect their future without jeopardizing their eligibility for vital government benefits?

This guide provides essential estate planning tips for parents of children with special needs. You’ll learn how to protect your loved one’s government benefits, appoint trusted decision-makers and ensure their financial security – all while minimizing stress and complications for your family.

Estate Planning Ground Rules

Overview

Estate planning is vital for directing how your assets are distributed, ensuring they go to your chosen beneficiaries instead of being determined by state laws.

Key Points

– Directs asset distribution according to your wishes, avoiding state intestacy law.

– Names an executor for your will, minimizing legal complications.

– Aims to reduce or eliminate estate and inheritance taxes through strategic planning with wills and/or trusts.

– Reduces contested estate risks, saving time and legal fees.

Summary

Ensuring your assets are distributed according to your desires involves strategic planning, which can significantly reduce taxes and legal conflicts, ultimately protecting your beneficiaries from unnecessary stress.

Power of Attorney Ground Rules

Overview

A Power of Attorney (POA) is essential for designating someone to manage your financial decisions should you become incapacitated. It also avoids the need for court-appointed guardianship.

Key Points

– Designates a trusted representative for financial decisions.

– Helps avoid costly and intrusive court guardianship.

– Essential for comprehensive estate planning.

– Can be tailored to specific situations (e.g., limited power of attorney for healthcare decisions).

Summary

Appointing a durable POA is a proactive step in estate planning that safeguards your financial affairs against court intervention and ensures a trusted individual handles your matters.

Advanced Medical Directive Ground Rules

Overview

An Advanced Medical Directive (AMD) ensures that your healthcare wishes are respected, designating a representative to make decisions if you cannot.

Key Points

– Appoints a healthcare representative for incapacitated individuals.

– Includes a HIPAA release for access to private medical information.

– Prevents family disputes by providing clear, end-of-life medical directives.

– Allows you to specify your wishes for medical treatments, including pain management, artificial life support and other interventions.

Summary

An AMD is a vital document that speaks for you when you cannot, ensuring your healthcare preferences are known and respected, and preventing potential disputes among family members.

Parent Estate Planning for Disabled Beneficiaries

Parents of beneficiaries with disabilities must take special considerations when planning their estate to ensure their care does not jeopardize eligibility for government benefits, such as creating safeguards like special needs trusts to ensure their child’s financial security doesn’t compromise necessary government assistance.

Charitable Gifting & Estate Planning

Overview

Including charitable gifting in your estate planning can offer significant tax benefits while supporting causes important to you.

Key Points

– Provides income and gift tax deductions.

– Can be executed through wills, trusts, charitable remainder trusts, or as a beneficiary of your retirement assets or life insurance policy.

– Donating to charities that support individuals with special needs can help provide enrichment programs that benefit your child and countless others.

– Reduces your estate’s taxable value.

Summary

Charitable gifting is a way to leave a lasting legacy, offering tax advantages for your estate while contributing to the welfare of your community or favorite cause.

Guardianships

Overview

Guardianship involves court appointments for individuals who are unable to make decisions for themselves, requiring documentation and legal proceedings.

Key Points

– Necessitates reports from two physicians and various legal documents.

– Manages both financial and medical decisions.

– Guardians must report to the court annually.

– Tailored to the individual’s needs. Guardianships can be limited or full, managing finances, medical care, or both.

Summary

Though guardianship can be a lengthy process, it’s a crucial safety net for protecting individuals who cannot make decisions for themselves, ensuring they have a responsible party to manage their affairs.

Special Needs Trust and Third-Party Trusts

Overview

Trusts designed for beneficiaries needing government assistance must be carefully structured so as not to affect their benefits.

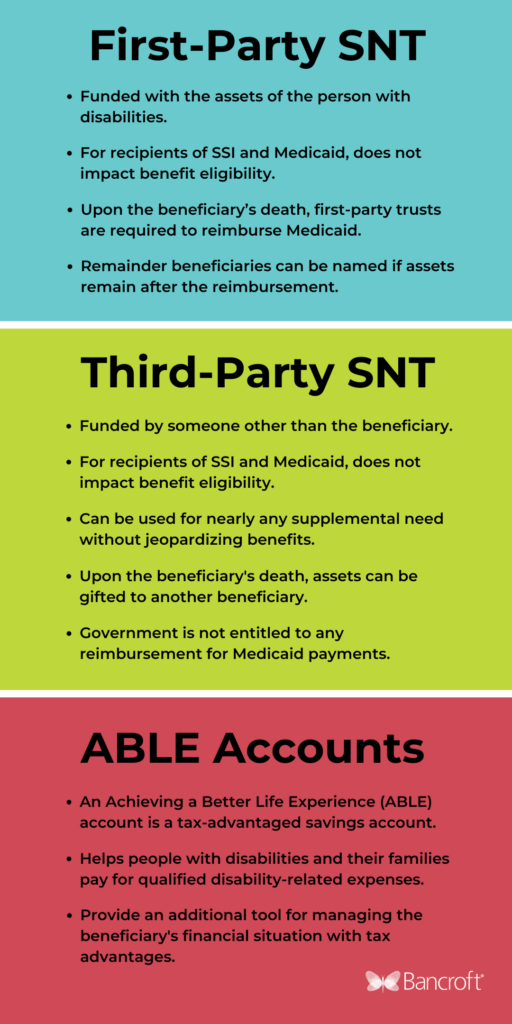

First-Party Special Needs Trust (SNT):

– Funded with the assets of the person with disabilities.

– For recipients of SSI and Medicaid, does not impact benefit eligibility.

– Upon the beneficiary’s death, first-party trusts are required to reimburse Medicaid. Remainder beneficiaries can be named if assets remain after the reimbursement.

Third-Party Special Needs Trust:

– Funded by someone other than the beneficiary.

– For recipients of SSI and Medicaid, does not impact benefit eligibility.

– Can be used for nearly any supplemental need without jeopardizing benefits.

– Upon the beneficiary’s death, the assets can be gifted to another beneficiary, and the government is not entitled to any reimbursement for Medicaid payments.

ABLE Account:

– An Achieving a Better Life Experience (ABLE) account is a tax-advantaged savings account that can help people with disabilities and their families pay for qualified disability-related expenses.

– These accounts provide an additional tool for managing the beneficiary’s financial situation with tax advantages.

– Upon the beneficiary’s death, the state can file a claim for all or a portion of the remaining funds for repayment.

Summary

Trusts and ABLE accounts are instrumental for individuals with disabilities, protecting their eligibility for government assistance while providing financial security.

Peace of Mind: The Most Compelling Reason to Estate Plan

Estate planning isn’t just about paperwork and legalities; it’s about giving yourself and your loved ones the ultimate gift – peace of mind. Taking these proactive steps ensures your loved one’s future is secure, their needs are met, and your family is protected. You can face the future confidently, knowing you’ve done everything possible to safeguard your loved one’s well-being.

To learn more about how you can support Bancroft with charitable gifting, please contact:

Tess Tebaldi, Associate Vice President of Development

856-348-1162

About the Author

As the founder and managing partner of Timothy Rice Estate and Elder Law Firm, Tim Rice has focused his law practice since 1991 exclusively on estate and elder law matters. His expertise includes:

- Estate and trust planning matters, such as drafting wills, powers of attorney, advance medical directives, and special needs trusts.

- Estate and trust administration.

- Estate litigation, including contested wills and guardianship disputes.

- Medicaid planning, including asset protection, Medicaid applications, and appeals.

- Special needs trust and disability planning.

- Residential real estate.

- Veterans’ benefits planning.

Tim Rice is committed to providing comprehensive and compassionate legal services to his clients, ensuring their estate planning needs are met with the utmost professionalism and care.

Disclaimer:

The information provided in this article is for general informational purposes only and does not constitute legal advice. The content herein may not apply to your specific circumstances, and it is strongly recommended that you seek the advice of a qualified attorney or financial advisor who can provide guidance tailored to your individual situation. The author and Bancroft disclaim any liability for any actions taken based on the information contained in this article.